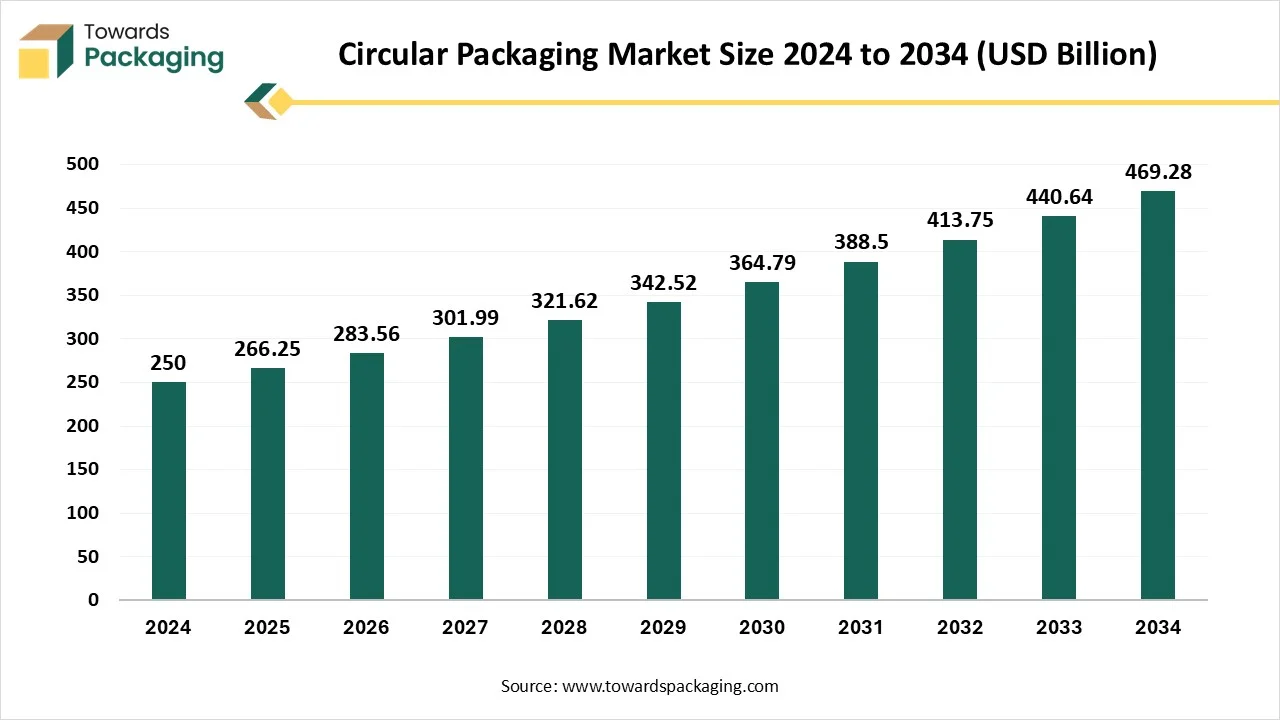

Circular Packaging Market to Reach USD 469.28 Billion by 2034, Growing from USD 266.25 Billion at a CAGR of 6.5%

According to Towards Packaging consultants, the global circular packaging market is projected to reach approximately USD 469.28 billion by 2034, increasing from USD 250 billion in 2024, at a CAGR of 6.5% during the forecast period 2025 to 2034.

Ottawa, Aug. 12, 2025 (GLOBE NEWSWIRE) -- The global circular packaging market size stood at USD 266.25 billion in 2025 and is projected to reach USD 469.28 billion by 2034, according to a study published by Towards Packaging, a sister firm of Precedence Research.

The market is witnessing significant growth due to increasing environmental concerns and stringent government regulations promoting sustainability. This market is driven by the rising demand for eco-friendly packaging solutions that minimize waste and promote reuse, recycling, and material recovery.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5664

Companies across various sectors, especially food and beverage, personal care, and e-commerce, are increasingly adopting circular packaging to align with sustainability goals and consumer preferences. Technological innovations, such as biodegradable materials and reusable packaging systems, are further boosting adoption. Additionally, collaboration among stakeholders—manufacturers, policymakers, and consumers is playing a crucial role in driving the transition toward a circular packaging economy.

What is meant by Circular Packaging?

Circular packaging refers to a sustainable packaging approach designed to minimize waste and environmental impact by keeping materials in use for as long as possible through reuse, recycling, and regeneration. Unlike traditional linear packaging, which follows a “take-make-dispose” model, circular packaging is rooted in the principles of the circular economy. It aims to design out waste from the beginning by using renewable, recyclable, or compostable materials.

Products are created to be reused multiple times or easily recycled without degrading quality. This approach involves the entire packaging lifecycle—from sourcing and production to consumption and post-use management. It encourages the use of materials that can be continuously cycled back into the economy, reducing the need for virgin resources. Businesses adopting circular packaging also focus on efficient logistics and reverse supply chains to recover used materials.

What Are the Latest Key Trends Shaping the Circular Packaging Market?

-

Regulatory and Business Model Shifts

Reuse-Oriented Business Models: Reuse systems are gaining traction as a stronger solution than recycling, capable of reducing packaging production by up to 90% and emissions by 80%. Scaling such models requires investment in infrastructure, standardization, and cultural adoption through initiatives like PR3 and Rebrand Reuse. Extended Producer Responsibility (EPR) and Regulatory Compliance: Legislation like the EU’s Packaging and Packaging Waste Regulation (PPWR) sets ambitious reuse targets (e.g., 40% reuse by 2030 for transport packaging). Meanwhile, global EPR mandates are increasingly pressuring brands to manage packaging end-of-life through compliance and investment.

-

Material Innovation and Eco-Design

Bio‑Based, Compostable & Edible Materials: Innovations span water-soluble bioplastics, mushroom‑based regenerative packaging, seaweed or agricultural waste-derived materials, and even edible formats that eliminate waste altogether. Natural Inks and Organic Coatings: Water‑based and vegetable-based inks are replacing conventional options, improving safety and recyclability. Eco‑friendly barrier coatings using substances like starch or cellulose are also being adopted to replace traditional plastic films.

-

Smart and Connected Packaging

Smart Packaging Technologies: QR codes, RFID, NFC, and IoT sensors are increasingly integrated into packaging to inform consumers, enable traceability, and support recycling. For instance, WestRock is embedding QR-enabled pizza boxes and using AI for authenticity and waste reduction. Battery-Free Active Packaging: Cutting-edge systems now integrate gas sensors and NFC, powered wirelessly, to monitor product freshness and release active compounds that extend shelf life.

-

Transparency & Consumer Engagement

Carbon Labelling: Carbon footprint labels (e.g., “A” to “E” rating per kg CO₂e) on packaging help consumers make informed, sustainability-oriented choices. Design and Branding Trends: Minimalist, visually clean designs, vintage aesthetics, and emotionally resonant packaging styles (like “dopaminergic” looks) are gaining popularity for both sustainability messaging and shelf impact.

-

Geographic and Material Footprint

Regional R&D Initiatives: In India, ICAR‑CCRI and VNIT are creating biodegradable packaging from sweet orange peel waste, helping turn agricultural by-products into sustainable alternatives. Flexible, Mono‑Material Packaging: Manufacturers increasingly use single-component flexible materials (e.g., mono-PE Mylar pouches) to facilitate recycling, with packaging that meets regulations like the EU Green Deal.

If there is anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

What is the Potential Growth Rate of the Circular Packaging Market?

-

Rising Environmental Concerns

Growing awareness of climate change, plastic pollution, and resource depletion is pushing businesses and consumers toward sustainable practices. Circular packaging, which reduces waste and promotes recycling or reuse, is seen as a viable solution to reduce environmental impact.

-

Changing Consumer Preferences

Consumers are becoming more eco-conscious and prefer products with sustainable packaging. This shift in preference is encouraging brands to innovate and adopt circular packaging to retain customer loyalty and market share.

-

Advancements in Packaging Technology

Innovations in materials science, such as bio-based plastics, compostable films, and recyclable mono-materials, have made circular packaging more efficient, affordable, and scalable, supporting its broader adoption.

-

Collaborations and Circular Economy Models

Cross-industry collaborations, such as reusable packaging platforms and take-back programs, are promoting a shared infrastructure for circular packaging. These efforts make it easier for brands to transition from linear to circular models.

Limitations & Challenges in the Circular Packaging Market

Lack of Standardization & Limited Infrastructure for Collection and Recycling

There is no global standard for what qualifies as "circular" packaging. The absence of clear guidelines and uniform certification makes it difficult for manufacturers to design compliant products and for consumers to identify truly sustainable packaging. Many regions lack the necessary waste collection, sorting, and recycling infrastructure to support circular packaging systems. Without robust systems in place, circular materials often end up in landfills, defeating the purpose.

More Insights of Towards Packaging:

- Glass-to-Plastic Packaging Market - The glass-to-plastic packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- Smart Packaging for Retail & E-Commerce Market - The global smart packaging for retail & e-commerce market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- Single-Use Packaging Alternatives Market - The single-use packaging alternatives market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034.

- Logistics-Optimized Packaging Market - The logistics-optimized packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- Carbon-Negative Packaging Market - The carbon-negative packaging market is predicted to expand from USD 96.75 billion in 2025 to USD 170.97 billion by 2034, growing at a CAGR of 6.53%.

- Blockchain-Integrated Smart Packaging Market - The blockchain-integrated smart packaging market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034.

- Industrial Bulk Packaging Market - The global industrial bulk packaging market is projected to reach USD 37.86 billion by 2034, expanding from USD 28.39 billion in 2025.

- Bimodal HDPE Market - The bimodal HDPE market is forecast to grow from USD 11.94 billion in 2025 to USD 24.87 billion by 2034, driven by a CAGR of 8.5% from 2025 to 2034.

- IoT-Enabled Packaging Market - The global IoT-enabled packaging market is anticipated to grow from USD 20.26 billion in 2025 to USD 29.95 billion by 2034.

- NFC-Embedded Packaging Market - The global NFC-embedded packaging market is set to grow from USD 5.87 billion in 2025 to USD 19.22 billion by 2034, with an expected CAGR of 14.13%.

Regional Analysis:

Who is the Leader in the Circular Packaging Market?

Europe is a dominant region in the circular packaging market due to its strong regulatory framework, high environmental awareness, and robust recycling infrastructure. The European Union has implemented strict policies like the Packaging and Packaging Waste Directive and the Circular Economy Action Plan, which mandate recycling targets and promote sustainable packaging practices. Additionally, European consumers are increasingly eco-conscious, driving demand for recyclable and reusable packaging.

Governments and industries are actively investing in R&D for biodegradable and compostable materials. Cross-sector collaborations, public-private partnerships, and circular economy funding initiatives further support innovation and large-scale adoption of circular packaging across the region.

Germany Market Trends

Germany excels due to its mature regulatory framework and strong infrastructure. The Packaging Act (VerpackG) enforces producer compliance with recyclability standards and participation in dual collection systems, supported by the Green Dot system, resulting in high recycling rates (e.g., plastic packaging over 47% in 2021). The foundational Waste Management Act (KrWG, 1996) embeds concepts like product responsibility and the waste hierarchy, prioritizing prevention, reuse, and recycling. Additionally, long-running deposit-return schemes (Pfandsystem), such as the Milch Mehrweg Pool, have scaled reuse culture with standardization and cooperation across businesses.

France Market Trends

France is driven by robust legislative action through the Anti-Waste and Circular Economy Law (2020), banning single-use plastics, prohibiting the destruction of unsold goods, and enforcing eco-labeling and transparency. These regulations are bolstered by rising consumer demand for sustainable packaging solutions, especially in food, cosmetics, and retail sectors. The push towards fibre-based and reusable materials is accelerating, particularly in the ecommerce and food-service industries. However, France still lags behind targets with plastic packaging recycling below 27%, well under the EU average.

Netherlands Market Trends

In the Netherlands, circularity is bolstered by high material recycling rates approximately 31% of used materials recycled. The country is also deploying innovative schemes to improve collection performance, such as depot-style “Statiegeld” return shops, which facilitate deposit returns for plastic and cans, aiding compliance with targets like 90% beverage container return rates. Earlier pilot projects in supermarkets focused on "packageless" bulk options, further showcasing the shift toward reusable systems.

Belgium Market Trends

Belgium ranks among the highest in Europe for packaging waste recycling—79% in 2020—and maintains a circular material use rate of 23%. This success is backed by aligning swiftly with EU Circular Economy Action plans and through national strategies such as “Circular Flanders” (targeting a 2050 circular economy) and “Circular Wallonia,” each with specific measurable goals and public-private initiatives.

How is the Opportunistic Rise of North America in the Circular Packaging Market?

North America is experiencing rapid growth in the circular packaging market due to a combination of regulatory action, corporate sustainability initiatives, and rising consumer awareness. Governments in the U.S. and Canada are introducing Extended Producer Responsibility (EPR) programs and plastic waste reduction laws that are pushing businesses to adopt circular models. Major corporations are committing to zero-waste goals and sustainable packaging targets, driving demand for recyclable, reusable, and compostable materials. Innovations in bioplastics, fiber-based packaging, and smart technologies are gaining traction across sectors like food, beverage, and e-commerce.

Additionally, consumers are increasingly favoring brands that prioritize sustainability, encouraging companies to redesign packaging for reuse and recyclability. Strong investment in recycling infrastructure and material recovery is further accelerating regional market expansion.

U.S. Market Trends

The circular packaging momentum in the U.S. is being propelled by significant state-level Extended Producer Responsibility (EPR) initiatives that place accountability on producers for packaging waste management. States such as California, Maine, Oregon, Colorado, Minnesota, New Jersey, and Washington have enacted EPR laws requiring producers to fund collection, recycling infrastructure, and service enhancements. California’s landmark SB 54 mandates that by 2032, all packaging be recyclable or compostable, with recycled content targets and a requirement to establish a Producer Responsibility Organization (PRO).

Minnesota’s 2024 legislation requires that by 2032, all packaging be recyclable, refillable, or compostable, with producers sharing the costs of recycling. Washington’s 2025 law ties producer contributions to recycling system funding, scaling up support to reimburse municipalities, improve infrastructure, and educate consumers. This layered regulatory landscape is driving manufacturers to design more sustainable, easily recyclable packaging and supports a transition toward circular supply chains.

Canada Market Trends

In Canada, the push for circular packaging is grounded in a coordinated EPR rollout across provinces, guided by the Canada-wide Action Plan on Zero Plastic Waste. The majority of provinces—including British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, New Brunswick, and Nova Scotia—are implementing or transitioning to full EPR systems, many using Producer Responsibility Organizations (PROs) to handle logistics, funding, and reporting. British Columbia led the way in 2014 with a mature EPR plan for packaging and paper products that consistently hit recovery targets.

Quebec is modernizing its selective collection and deposit systems to complete the EPR transformation by 2025. Ontario is working through a phased Blue Box transition to full producer-funded packaging management, while other provinces like Alberta, Saskatchewan, and Nova Scotia are also rolling out multi-phase EPR systems with a planned 2025 implementation and beyond. This evolving regulatory framework, combined with infrastructure investments and harmonized stewardship programs, is accelerating Canada’s circular packaging adoption.

How Big is the Success of the Asia Pacific Circular Packaging Market?

Asia‑Pacific is experiencing notable growth in the circular packaging market, powered by several impactful factors. Rapid urbanization and a burgeoning middle class across countries like India and China are fueling surging demand for packaged goods, especially through e‑commerce, which in turn drives interest in sustainable packaging formats. Extended Producer Responsibility (EPR) regulations in nations such as Vietnam, Australia, and Thailand are boosting investment in recycled-content materials and supporting infrastructure.

Strong expansion in sectors like food, beverage, pharmaceuticals, and healthcare is increasing the need for high‑barrier, recyclable substrates. Fueling efficiency and customization, AI‑enabled design and digital printing technologies are being adopted to meet diverse SKU demands. Together, these market dynamics are propelling the Asia‑Pacific region's rapid ascent in circular packaging.

How Crucial is the Role of Latin America in the Circular Packaging Market?

Latin America is witnessing considerable growth in the circular packaging market due to rising eco-consciousness among consumers, growing demand for sustainable packaging alternatives, and proactive industry and government initiatives. The expansion of e-commerce and rapid urbanization are driving the need for lightweight, flexible, and recyclable packaging solutions. Countries like Brazil are leading with policies such as the National Solid Waste Policy and innovations like Suzano’s Greenpack, while Mexico sees major companies like Grupo Bimbo committing to 100% recyclable or compostable packaging by 2025. Additionally, Chile’s Extended Producer Responsibility (EPR) law is accelerating the adoption of recyclable packaging across industries.

How does the Middle East and Africa lead the Circular Packaging Market?

The Middle East and Africa present significant opportunities for growth in the circular packaging market due to increasing environmental awareness, urbanization, and regulatory efforts promoting sustainable practices. Governments in countries like the UAE and Saudi Arabia are launching green initiatives and circular economy strategies, encouraging industries to adopt recyclable and biodegradable packaging materials.

Rapid growth in sectors such as food and beverages, healthcare, and retail is also boosting demand for eco-friendly packaging. Moreover, rising consumer preference for sustainable products and the gradual development of recycling infrastructure across the region are opening new avenues for innovation and investment in circular packaging solutions.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Segment Outlook

Material Type Insights

The recycled material segment holds dominance in the circular packaging market due to its critical role in reducing environmental impact and supporting sustainability goals. With growing pressure from environmental regulations and global movements to curb plastic pollution, industries are increasingly turning to materials like recycled paper, plastics, and metals to meet eco-friendly mandates. These materials significantly reduce the demand for virgin resources and lower greenhouse gas emissions during production.

Moreover, advancements in recycling technologies have improved the quality and usability of recycled materials, making them viable for diverse packaging applications. Consumer preference for sustainable packaging further reinforces the dominance of this segment.

The biodegradable and compostable material segment is the fastest-growing in the circular packaging market due to increasing global emphasis on eco-friendly and zero-waste solutions. Consumers and industries are actively seeking alternatives to traditional plastic packaging, driven by rising awareness of plastic pollution and its environmental consequences. Governments worldwide are implementing strict regulations banning single-use plastics and encouraging the use of biodegradable materials.

Additionally, innovations in biopolymer technology and the availability of plant-based materials like PLA, starch blends, and bagasse are enhancing the performance and scalability of compostable packaging. These factors collectively drive rapid adoption across food service, retail, and e-commerce sectors.

Packaging Format Insights

The rigid circular packaging segment is dominant in the circular packaging market due to its durability, reusability, and superior protection capabilities. Rigid formats such as bottles, jars, and containers made from recycled plastics, glass, or metals are widely adopted across industries like food and beverages, personal care, and household products. These materials are not only easy to collect, clean, and recycle but also maintain product integrity during transportation and storage.

Additionally, consumers perceive rigid packaging as more premium and reliable, increasing its appeal. The growing focus on refillable and returnable packaging systems further strengthens the dominance of rigid circular packaging solutions.

The flexible circular packaging segment is the fastest-growing packaging format in the circular packaging market due to its lightweight nature, cost-efficiency, and reduced environmental footprint Flexible packaging uses fewer raw materials and generates less waste, making it an attractive option for brands aiming to meet sustainability targets. It is highly adaptable and suitable for a wide range of industries, including food, pharmaceuticals, and personal care. Innovations in recyclable and compostable films have further enhanced the segment’s appeal.

Additionally, the rising demand for convenient, resealable, and space-saving packaging, especially in e-commerce and retail, continues to accelerate the growth of flexible circular packaging solutions.

Function Insights

The primary packaging segment dominates the circular packaging market due to its direct interaction with the product and crucial role in ensuring safety, shelf life, and consumer appeal. It is the first layer of packaging that protects goods from contamination, damage, and spoilage, especially in industries like food, beverages, pharmaceuticals, and cosmetics. With increasing demand for sustainable consumption, brands are shifting to circular primary packaging materials such as recycled plastics, biodegradable films, and compostable paper to reduce environmental impact.

Moreover, consumer awareness and regulatory pressure are pushing companies to adopt eco-friendly primary packaging solutions that maintain product integrity while supporting sustainability goals.

The secondary packaging segment is the fastest-growing in the circular packaging market due to its vital role in logistics, branding, and sustainability. As businesses focus on reducing packaging waste and improving recyclability, secondary packaging such as cartons, boxes, and wraps is being redesigned using recycled or biodegradable materials. It serves as an effective medium for brand communication while offering structural support and protection during transportation.

The rise of e-commerce and retail sectors has further fuelled demand for sustainable and visually appealing secondary packaging. Additionally, circular practices like reusable shipping boxes and modular packaging designs are driving innovation and growth in this segment.

Packaging Lifecycle Model Insights

The recyclable packaging segment is the dominant packaging lifecycle model in the circular packaging market due to its widespread acceptance, infrastructure support, and effectiveness in reducing environmental impact. Recyclable packaging enables materials like paper, cardboard, glass, metals, and certain plastics to re-enter the production cycle, significantly lowering raw material consumption and waste generation. Governments and regulatory bodies are actively promoting recycling through mandates, incentives, and awareness campaigns, making it a preferred choice for manufacturers and consumers.

Additionally, advancements in material science and sorting technologies have improved recycling efficiency, encouraging industries to adopt recyclable packaging as a core part of their sustainability strategies.

The reusable packaging segment is the fastest-growing packaging lifecycle model in the circular packaging market due to rising environmental awareness and the growing need to minimize single-use waste. Businesses across industries are embracing refillable containers, returnable transport packaging, and durable materials to lower their carbon footprint and meet sustainability goals. Consumers are increasingly drawn to zero-waste lifestyles, boosting demand for packaging that can be used multiple times without compromising product safety or quality.

Additionally, supportive government policies and circular economy initiatives are encouraging investments in reusable packaging infrastructure. These factors collectively contribute to the rapid growth and adoption of reusable packaging solutions.

End-Use Industry Insights

The food and beverage segment dominates the circular packaging market due to its high consumption volume and strict regulatory standards demanding safe, sustainable packaging. As consumers become more environmentally conscious, brands are adopting recyclable, biodegradable, and compostable packaging solutions to reduce plastic waste and appeal to eco-aware buyers. The need for packaging that ensures freshness, hygiene, and extended shelf life further drives demand for innovative circular materials. Additionally, leading food and beverage companies are making strong sustainability commitments, pushing for closed-loop systems, and investing in packaging redesigns that align with circular economy goals, making this segment the largest in the market.

The personal care and cosmetics packaging segment is the fastest-growing end-use segment in the circular packaging market due to rising consumer preference for sustainable and ethically produced products. Brands are increasingly adopting eco-friendly packaging made from recycled, refillable, or biodegradable materials to align with environmental values and attract conscious consumers.

The industry's focus on premium aesthetics is being balanced with circular principles, leading to innovations like reusable containers, compostable tubes, and minimalistic designs that reduce waste. Regulatory pressures and global sustainability pledges by major cosmetic companies are also driving the shift toward circular packaging, fueling rapid growth in this segment.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in the Global Circular Packaging Market:

- In August 2025, the Feddersen Group and its partners won the coveted German Packaging Award for their creative approach to the packaging industry’s circular economy. In the “Sustainability-Use of Recyclates” category, the award honors their joint efforts in creating an eco-friendly packaging idea.

- In June 2025, ATP Inc., a leading provider of Memory solutions and Specialized Storage products, launches new environmentally friendly packaging, a box printed with a single white ink and constructed from uncolored natural cardboard. This calculated action addresses a specific goal: reducing the environmental impact of each product that is produced and delivered.

Access our exclusive, data-rich dashboard dedicated to the Circular Packaging Market built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more.

Access Now: https://www.towardspackaging.com/contact-us

Circular Packaging Market Companies

- Amcor plc

- Tetra Pak

- Smurfit Kappa Group

- Berry Global Inc.

- Mondi Group

- Sealed Air Corporation

- Ball Corporation

- DS Smith Plc

- Stora Enso Oyj

- EcoEnclose

- Loop Industries

- Ranpak Holdings Corp.

- Greif, Inc.

- Huhtamaki Oyj

- International Paper Company

- Papacks Sales GmbH

- Pactiv Evergreen Inc.

- UFlex Ltd.

- TIPA Corp Ltd.

- Vegware Ltd.

- Other Players

Circular Packaging Market Segments

By Material Type

- Recycled Materials

- Recycled Paper & Cardboard

- Recycled Plastics (PET, HDPE, LDPE, PP)

- Recycled Glass

- Recycled Metals (Aluminum, Steel)

- Biodegradable & Compostable Materials

- PLA (Polylactic Acid)

- PHA (Polyhydroxyalkanoates)

- Bagasse

- Cornstarch-based

- Paper Pulp

- Renewable/Bio-based Materials

- Bamboo

- Mushroom-based Packaging

- Palm Leaves

- Seaweed-based Packaging

By Packaging Format

- Rigid Circular Packaging

- Bottles & Jars

- Containers

- Cans

- Trays

- Flexible Circular Packaging

- Pouches

- Wraps

- Films

- Sachets

By Function

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

By End-Use Industry

- Food & Beverages

- Beverages

- Ready-to-Eat Meals

- Fresh Produce

- Snacks & Confectionery

- E-commerce & Retail

- Personal Care & Cosmetics

- Homecare Products

- Healthcare & Pharmaceuticals

- Industrial Goods

By the Packaging Lifecycle Model

- Reusable Packaging

- Returnable Transport Packaging

- Refillable Packaging (e.g., refill pouches)

- Recyclable Packaging

- Compostable/Biodegradable Packaging

- Upcycled Packaging

By Region

-

North America

- U.S.

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

-

Latin America

- Brazil

- Mexico

- Argentina

- South Africa

-

Middle East and Africa (MEA)

- UAE

- Saudi Arabia

- Kuwait

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/price/5664

Become a Valued Research Partner with Us - Schedule a meeting: https://www.towardspackaging.com/schedule-meeting

Request a Custom Case Study Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners:

Precedence Research | Statifacts |Towards Automotive | Towards Healthcare | Towards Food and beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Web Wire | Packaging Web Wire | Automotive Web Wire

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.